Stock Evaluation

Company Description: Go Easy

Company description: "Goeasy Ltd. is a Canada-based company, which provides non-prime leasing and lending services through its easyhome, easyfinancial and LendCare brands. The easyfinancial segment lends out capital in the form of unsecured and secured consumer loans to non-prime borrowers. Easyfinancial’s product offering consists of unsecured and real estate secured instalment loans. The LendCare operating segment specializes in financing consumer purchases in the powersports, automotive, retail, healthcare, and home improvement categories. The easyhome segment provides leasing services for household furniture, appliances and electronics and unsecured lending products to retail consumers. Its customers can transact seamlessly through an omnichannel model that includes online and mobile platforms, over 400 locations across Canada, and point-of-sale financing offered in the retail, powersports, automotive, home improvement and healthcare verticals.

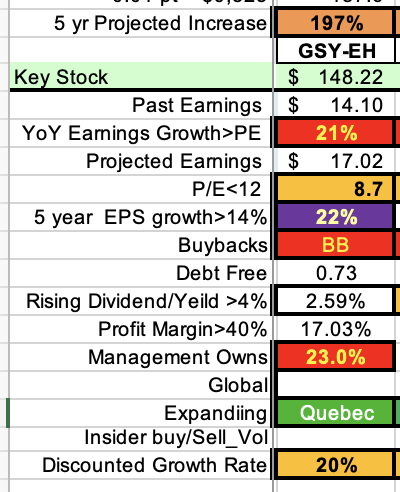

Checklist items (2023_12_14)

A growing marketplace: yes

Expanding: yes

Profit Margin: 17.03%

Earnings increase each year through the 5 year span: yes

Earnings compound rate growth over the 5 year span: 22%

5 Year earnings as a % of the present market stock price: 40.9%

Growth rate > P/E: yes (22% vs 8.7 P/E)

Phase: Maturing Growth

Dividend: 2.59%

Global: No: Canada Only

Directors buying/selling shares: no

Company buying/selling shares: no

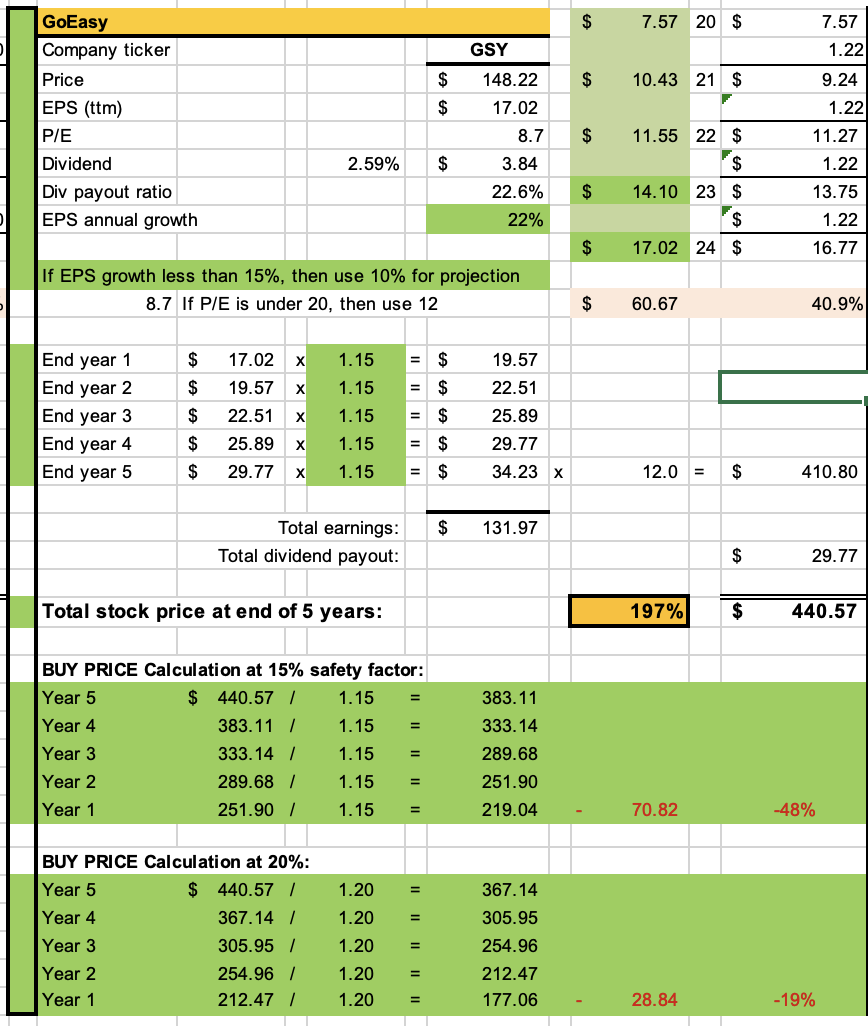

Algorithm results: GoEasy

In the last 3 years its revenue was $7.57, $10.43 & $11.55

This year it is projected to make $14.10 (estimates increasing)

Next year it is projected to make $17.02 (estimates increasing)

Algorithm projected EPS growth rate for next 5 years: 15%

Algorithm projected P/E for next 5 years: 12x

Algorithm projected market price in 5 years: $90.60

Algorithm project growth percentage over 5 years: 197%

Does the stock meet our projected CAGR of 14.4% (ie: double in 5years): yes

Buy price to meet projected 15% growth rate: $219.04

Buy price to meet projected 20% growth rate: $177.06

Todays buy price: $148.22

Algorithm