Profit Margin: 12.44%

Stock Evaluation

Company Description: Nuvei

Company description: “Nuvei Corporation provides electronic payment technology solutions to merchants and partners globally. Its solutions span the entire payments stack and include an integrated payments engine with global processing capabilities and a suite of data-driven business intelligence tools and risk management services. The Company’s platform provides pay-in and payout capabilities, connecting merchants with their customers in over 200 markets worldwide. Its platform supports more than 530 alternative payment methods (APMs), including cryptocurrencies, and over 150 currencies. It also enables online payments, mobile payment and in-store payments. Its platform enables customers to accept payments worldwide regardless of their customers’ location, device or preferred payment method. Its technology includes gateway, currency management, global payouts, card issuing, open banking, data reporting and reconciliation tools.”

Checklist items: Nuvei

A growing marketplace: yes

Expanding (it recently acquired Paya Holdings Inc): yes

Winning large contracts (ie: Sylogist & China): yes

Profit Margin: -0.50%

Earnings increase each year through the 5 year span: yes

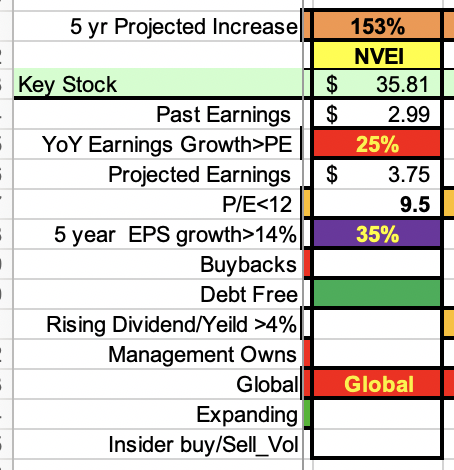

Earnings compound rate growth over the 5 year span: 35%

5 Year earnings as a % of the present market stock price: 33.5%

Growth rate > P/E: yes (35% vs 10.1 P/E)

Phase: Early Growth

Dividend: no

Global: yes

Directors buying/selling shares: no

Company buying/selling shares: no

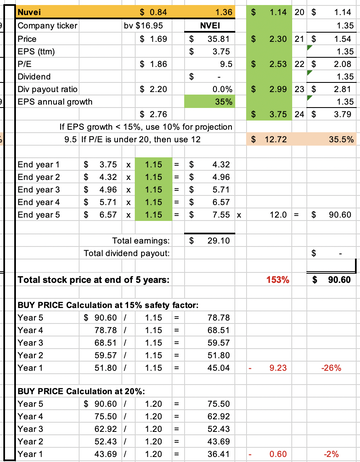

Algorithm results: Nuvei (calculated 2023_06_16)

In the last 3 years its revenue was $1.14, $2.30 & $2.53.

This year it is projected to make $2.99

Next year it is projected to make $3.75.

EPS growth through this period: 35%

Algorithm projected EPS growth rate: 15%

Algorithm projected P/E: 12x

Algorithm projected 2024 earnings: $3.75

Algorithm projected 2028 earnings: $7.55

Algorithm projected 2028 market price: $90.60

Algorithm project growth percentage over 5 years: 153%

Does the stock meet our projected CAGR of 14.4% (ie:double in 5years): yes

Buy price to meet projected 15% growth rate: $45.04

Buy price to meet projected 20% growth rate: $36.41

Cons:

Negative profit margin

Stock Evaluation

Company Description: Nuvei

Company description: “Nuvei Corporation provides electronic payment technology solutions to merchants and partners globally. Its solutions span the entire payments stack and include an integrated payments engine with global processing capabilities and a suite of data-driven business intelligence tools and risk management services. The Company’s platform provides pay-in and payout capabilities, connecting merchants with their customers in over 200 markets worldwide. Its platform supports more than 530 alternative payment methods (APMs), including cryptocurrencies, and over 150 currencies. It also enables online payments, mobile payment and in-store payments. Its platform enables customers to accept payments worldwide regardless of their customers’ location, device or preferred payment method. Its technology includes gateway, currency management, global payouts, card issuing, open banking, data reporting and reconciliation tools.”

Checklist items: Nuvei

A growing marketplace: yes

Expanding (it recently acquired Paya Holdings Inc): yes

Winning large contracts (ie: Sylogist & China): yes

Profit Margin: -0.50%

Earnings increase each year through the 5 year span: yes

Earnings compound rate growth over the 5 year span: 35%

5 Year earnings as a % of the present market stock price: 33.5%

Growth rate > P/E: yes (35% vs 10.1 P/E)

Phase: Early Growth

Dividend: no

Global: yes

Directors buying/selling shares: no

Company buying/selling shares: no

Algorithm results: Nuvei (calculated 2023_06_16)

In the last 3 years its revenue was $1.14, $2.30 & $2.53.

This year it is projected to make $2.99

Next year it is projected to make $3.75.

EPS growth through this period: 35%

Algorithm projected EPS growth rate: 15%

Algorithm projected P/E: 12x

Algorithm projected 2024 earnings: $3.75

Algorithm projected 2028 earnings: $7.55

Algorithm projected 2028 market price: $90.60

Algorithm project growth percentage over 5 years: 153%

Does the stock meet our projected CAGR of 14.4% (ie:double in 5years): yes

Buy price to meet projected 15% growth rate: $45.04

Buy price to meet projected 20% growth rate: $36.41

Cons:

Negative profit margin

Algorithm