Stock Evaluation

Company Description: Stingray

Company description: "Stingray Group Inc. operates as a music, media, and technology company worldwide. The company offers Stingray Music, Stingray Naturescape, Stingray Now 4K, and Stingray Festival 4K, a television channel that broadcasts exclusively in native 4K and Dolby Digital audio. It also provides Qello Concerts by Stingray, Calm Radio, Calm Christian, Stingray Classica, Stingray iConcerts, and Stingray DJAZZ. In addition, the company offers karaoke services comprising Yokee Piano, Stingray Kids' Karaoke, and Yokee Music, as well as Stingray Karaoke. Further, it provides music videos TV channels that include Stingray Country, Stingray cmusic, Palmarès ADISQ par Stingray, Stingray Hits!, Stingray Vibe, Stingray Loud, Stingray Retro, Stingray LiteTV, and Stingray Juicebox; and operates approximately 100 radio stations across Canada, as well as offers advertising solutions. The company distributes its products and services through various platforms that include digital cable TV, satellite TV, IPTV, OTT, the internet, mobile devices, game consoles, and connected cars. It serves cable and telecom companies, retailers, small and medium businesses, and directly to consumers. The company was founded in 2007 and is headquartered in Montreal, Canada.

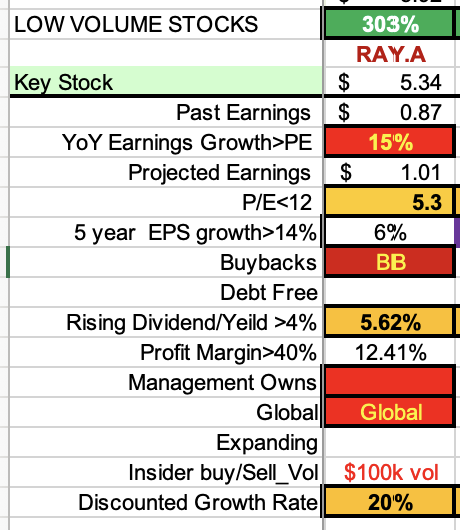

Checklist items (2023_12_14)

A growing marketplace: yes

Expanding: yes

Profit Margin: 12.41%

Earnings increase each year through the 5 year span: yes

Earnings compound rate growth over the 5 year span: 6%

5 Year earnings as a % of the present market stock price: 81.0%

Growth rate > P/E: yes (6% vs 5.3 P/E)

Phase: Maturing Growth

Dividend: 5.62%

Global: yes

Directors buying/selling shares: no

Company buying/selling shares: no

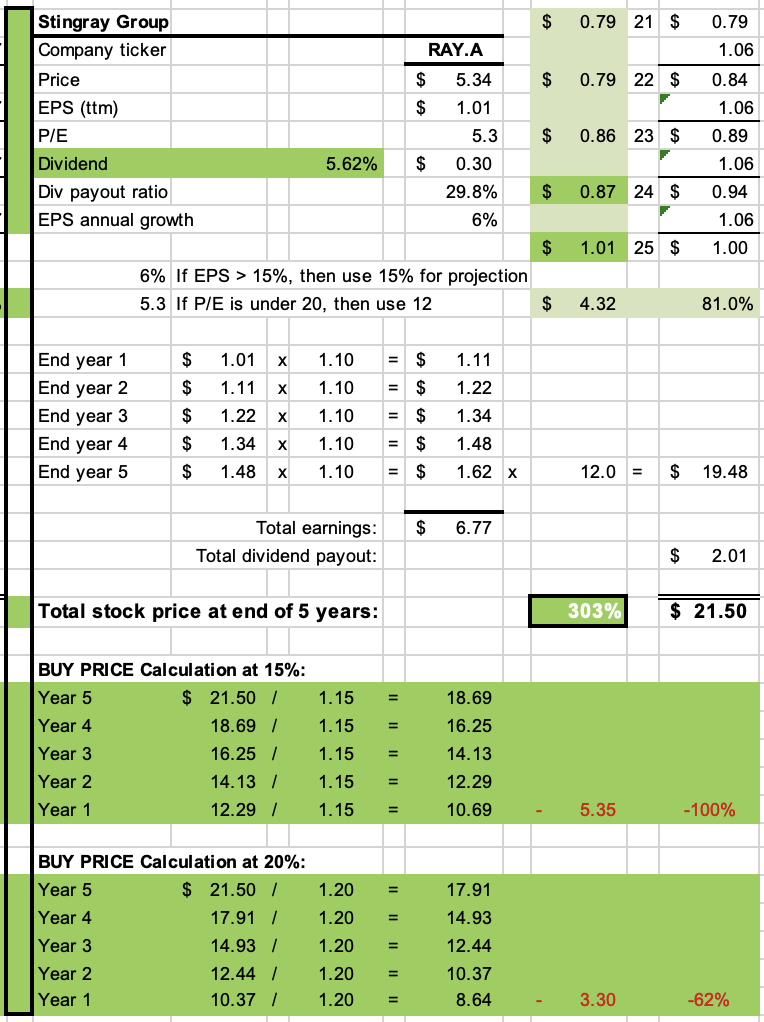

Algorithm results: Stingray

In the last 3 years its revenue was $0.79, $0.79 & $0.86

This year it is projected to make $0.87 (estimates increasing)

Next year it is projected to make $1.01 (estimates increasing)

Algorithm projected EPS growth rate for next 5 years: 15%

Algorithm projected P/E for next 5 years: 12x

Algorithm projected market price in 5 years: $21.50

Algorithm project growth percentage over 5 years: 303%

Does the stock meet our projected CAGR of 14.4% (ie: double in 5years): yes

Buy price to meet projected 15% growth rate: $10.69

Buy price to meet projected 20% growth rate: $8.64

Buy price on 2023_12_14: $5.34

Cons:

Low daily volume ($100k)

Algorithm