Stock Evaluation

Company Description: Suncor

Company description: "Suncor Energy Inc. operates as an integrated energy company in Canada and internationally. It operates through Oil Sands; Exploration and Production; and Refining and Marketing segments. The Oil Sands segment explores, develops, and produces bitumen, synthetic crude oil, and related products. This segment also engages in syncrude oil sands mining and upgrading operations; and marketing, supply, transportation, and risk management of crude oil, natural gas, power, and byproducts. The Exploration and Production segment is involved in offshore operations in the East Coast of Canada. The Refining and Marketing segment refines crude oil and petrochemical products; and markets, transports, and manages refined and petrochemical products, and other purchased products through the retail and wholesale networks. This segment also involved in trading of crude oil, natural gas, and power. The company is headquartered in Calgary, Canada."

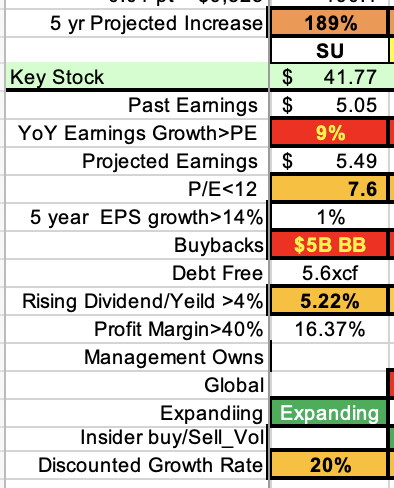

Checklist items (2023_12_14)

A growing marketplace: yes

Expanding: yes

Profit Margin: 16.37%

Earnings increase each year through the 5 year span: cyclical

Earnings compound rate growth over the 5 year span: cyclical

5 Year earnings as a % of the present market stock price: 49.3%

Growth rate > P/E: yes (cyclical)

Phase: Maturing Growth

Dividend: 5.22%

Global: yes

Directors buying/selling shares: no

Company buying/selling shares: no

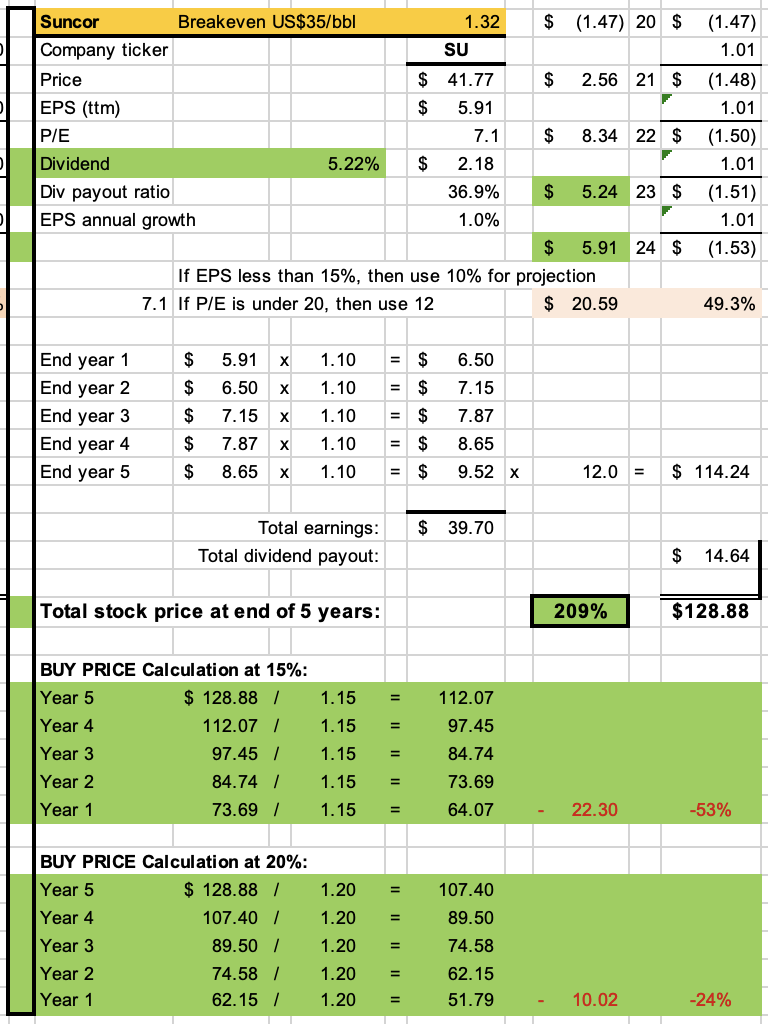

Algorithm results: Suncor

In the last 3 years its revenue was -$1.47, $2.56 & $5.91

This year it is projected to make $5.24 (estimates increasing)

Next year it is projected to make $5.91 (estimates increasing)

Algorithm projected EPS growth rate for next 5 years: 10%

Algorithm projected P/E for next 5 years: 12x

Algorithm projected market price in 5 years: $128.88

Algorithm project growth percentage over 5 years: 209%

Does the stock meet our projected CAGR of 14.4% (ie: double in 5years): yes

Buy price to meet projected 15% growth rate: $64.07

Buy price to meet projected 20% growth rate: $51.79

Buy price on 2023_12_14: $41.77

Cons:

Cyclical due to the commoditization of oil.

Unpredictable and at the mercy of economic cycles.

Algorithm