Stock Evaluation

Company Description: Wajax

Company description: "Wajax Corporation provides sales, parts, and services to construction, forestry, mining, industrial/commercial, oil sands, transportation, metal processing, government, utilities, and oil and gas sectors. The company offers compact excavators, dump trucks, excavators, wheel loaders, and wheeled excavators; aerial devices, boom lifts, cranes, digger derricks, drills, lifts, and material and scissor lifts; engines and transmissions; and feller bunchers, felling heads, flail debarkers, forwarders, grinders, harvesting heads, log loaders, skidders, track and wheel harvesters, and woodchippers. It also provides bearings, bulk material handling, filtration, fluid handling, hydraulics, industrial electric motors and variable frequency drives, instrumentation, pneumatics, power transmissions, and safety and mill supplies, as well as sealing, belting, lubricants, and hydraulic hoses; combination sweeper scrubbers, container handlers, electric ride scooters, end rider trucks, forklifts, order pickers, pallet stackers and trucks, reach stackers, rider and walk behind sweepers, side loaders, tow tractors, and utility vehicles; and equipment transport, filtration, fluid handling, mining excavators, rigid frame trucks, rope shovel, underground battery powered and drill jumbos, underground haul trucks and loaders, underground roof bolters and scaling machines, and underground utility trucks. In addition, the company offers power generation solutions; and cages and partitions, guarding and barriers, lockers, cabinets, workstations, rack accessories and protections, racking, shelving, and storage platforms, as well as storage system design, installation, and inspection services. Further, it offers equipment rentals, equipment parts and support, and engineered repair services. Wajax Corporation was founded in 1858 and is headquartered in Mississauga, Canada.

"

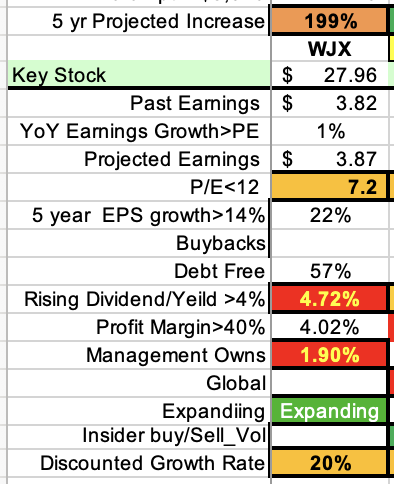

Checklist items (2023_12_14)

A growing marketplace: yes

Expanding: yes

Profit Margin: 4.02%

Earnings increase each year through the 5 year span: yes

Earnings compound rate growth over the 5 year span: 22.0%

5 Year earnings as a % of the present market stock price: 53.2%

Growth rate (22.0%) > P/E (7.2%): yes

Phase: Maturing Growth

Dividend: 4.70%

Global: no - Canada only

Directors buying/selling shares: no

Company buying/selling shares: no

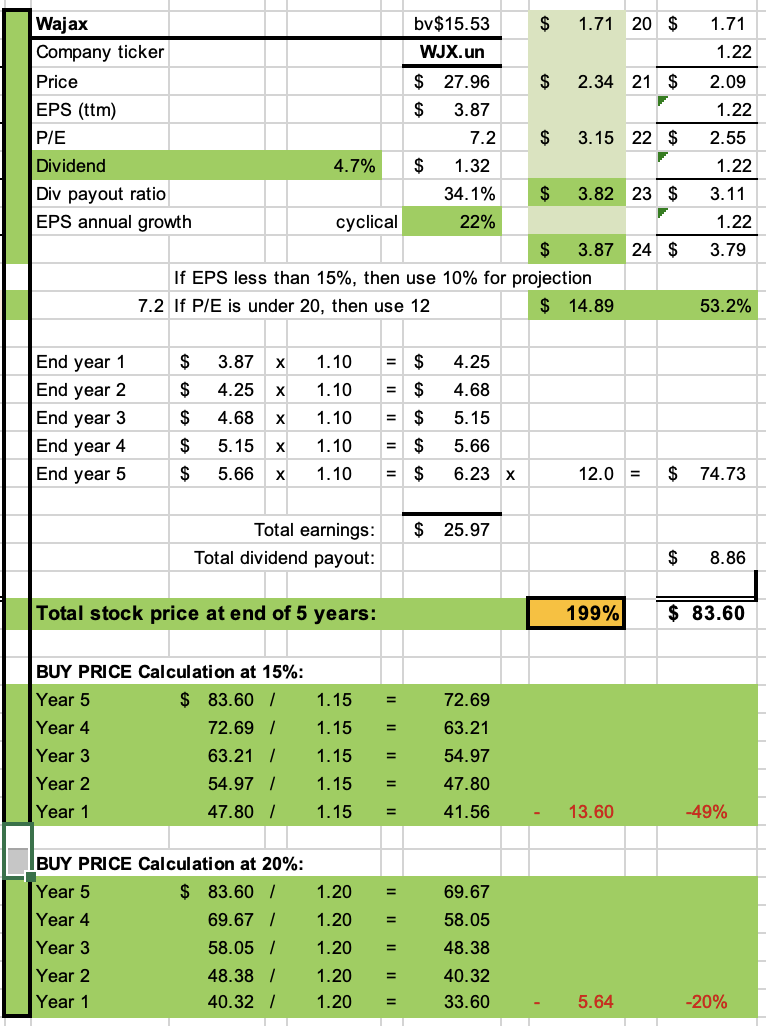

Algorithm results: Suncor

In the last 3 years its revenue was $1.71, $2.34 & $3.15

This year it is projected to make $3.82 (estimates increasing)

Next year it is projected to make $3.87 (estimates increasing)

Algorithm projected EPS growth rate for next 5 years: 10%

Algorithm projected P/E for next 5 years: 12x

Algorithm projected market price in 5 years: $83.60

Algorithm project growth percentage over 5 years: 199%

Does the stock meet our projected CAGR of 14.4% (ie: double in 5years): yes

Buy price to meet projected 15% growth rate: $41.56

Buy price to meet projected 20% growth rate: $33.60

Buy price on 2023_12_14: $27.96

Cons:

Only based in Canada

Tied to the oil cycle, but has been winning against it

Algorithm